The relevance of cyber insurance in 2025?

As of 2025, cybercrimes have become a global issue. A report says there are over 17 billion hacking attempts every day and about 5.5 billion malware attacks each year.. And this is exactly why the cyber insurance market size is estimated to be valued at $19.35 billion in 2025 and is expected to reach $71.44 billion by 2032. This exhibits a compound annual growth rate or CAGR of 20.5% from 2025 to 2032. By definition, cyber insurance protects businesses and individuals from financial losses incurred due to cyberattacks, such as data breaches, ransomware attacks, and phishing. It usually covers costs such as legal fees, data recovery, business interruption, customer notification, and even ransom payments. Companies that handle sensitive data surely need cyber insurance.

Upsurge in cyber insurance amid the digital era

Post the 2020 COVID-19 pandemic, there has been a significant expansion in the adoption of the remote work culture and cloud computing. This has left organizations more vulnerable than ever to cyberattacks. The primary reasons for the widened exposure to threats are unsecured home networks, BYOD (Bring Your Own Device) culture, untrained employees, lack of IT oversight, third-party dependencies, and overly permissive data access configurations. This very scenario has given cyber insurance the due importance. Companies are understanding how crucial it is to have comprehensive coverage against losses arising from grave, targeted cyberattacks. Cyber insurance is no longer a luxury; it’s instead a savior from the double-edged digital transformation sword.

New regulations and compliances are playing their role

In 2025, compliance pressure is one of the significant drivers for organizations to adopt cyber insurance, as global regulations are mandating robust cybersecurity measures and transparent incident reporting. Here’s how they are playing their part-

EU: Digital Operational Resilience Act (DORA)

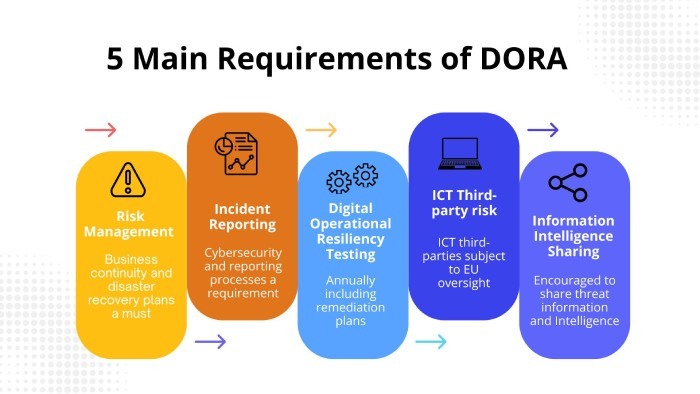

Effective from January 17th, 2025, the European Union’s Digital Operational Resilience Act (DORA) requires financial entities—such as banks, insurance companies, and investment firms—to implement comprehensive ICT risk management frameworks. As per this, organizations should rigorously test digital operational resilience and follow detailed incident reporting protocols. While DORA doesn’t say anything explicitly about cyber insurance, the strict rules and risk of penalties make having insurance a smart way to stay protected and meet compliance expectations.

US: SEC Cybersecurity Disclosure Rules

In July 2023, the U.S. Securities and Exchange Commission (SEC) adopted new rules compelling public companies to:

- Disclose material cybersecurity incidents within four business days.

- Detail their cybersecurity risk management strategies and governance in annual reports.

These rules, in effect since December 18, 2023, have pushed companies to strengthen their cybersecurity and consider cyber insurance to avoid big financial losses.

Final thoughts

We are getting more and more reliant on technology, which is not wrong, provided we also take care of the cyberattacks that come with it. With so many online risks looming over us, cyber insurance gives peace of mind and financial protection against grave cyber hits. Since personal and business data are so valuable now, having this coverage has become a must-have for public and private organizations. So, if your business still lacks cyber insurance, take this blog as a sign.